Where should you bank? Would you prefer a conventional brick-and-mortar bank with local branches and a network or ATMs? Do you want to stick to a popular online banking system? Each option has benefits and downsides.

Depositing funds is more accessible with traditional banks, which also offer on-demand personal services. Online banks have lower charges and better interest rates.

Decide which features are most significant to you before you select the right bank. Here is what you need to consider about online banking.

History of Online Banking

Source: pexels.com

Online banks have become widespread for the past two decades. You may only obtain a $3000 loan bad credit from the comfort of your home with no hassle of paperwork. At the same time, borrowers had to wait in long queues before and collect numerous documents just to submit their applications in person.

The Internet became more commercialized in the 1990s. Conventional banking institutions started searching for ways to boost their online presence and deliver their services and products across the web.

At first, online banking options were somewhat limited, with few banks offering such web products to clients.

Later, these institutions improved online features and created user-friendly websites that allowed consumers to download documents and forms, easily open new bank accounts, and submit loan requests without delay. Hence, online-only banks have gradually evolved and increased.

Traveling to a physical bank branch to receive different financial services or get a consultation with a specialist is optional. The Security First Network Bank became the first online bank in 1995.

Benefits of Online Banks

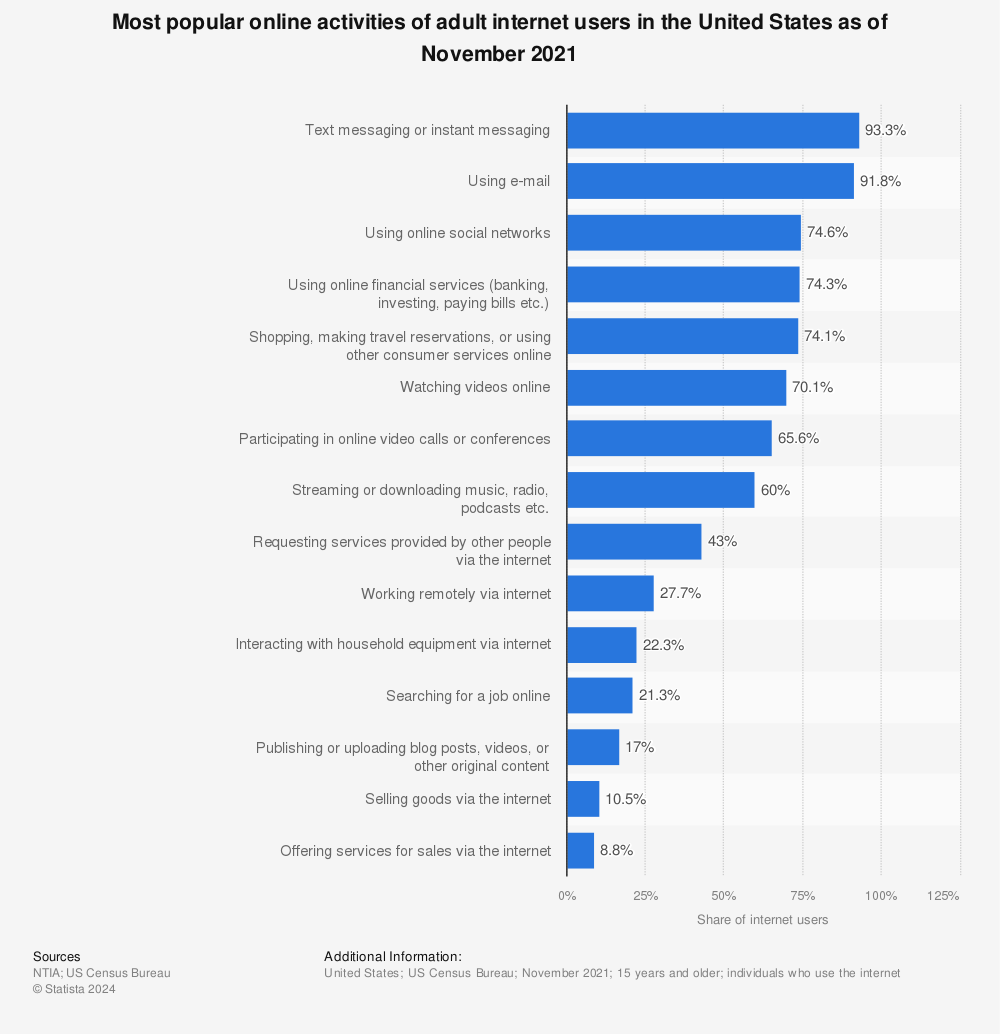

As of November 2024, it was estimated that using online financial services such as banking, investing, and paying bills was one of the most popular online activities of adult Internet users in the USA, mentions Statista.

More and more clients choose digital banks and mobile apps to access financial services.

Most popular online activities of adult internet users in the United States as of November 2024

Here are the main pros of digital banking:

- Easy to Open. Digital banking allows clients to open a checking account at any time of the day. There are no waiting lines or paperwork. The account can be opened even at the weekend. The consumers also save time and don’t need to go to a physical bank location. Your private data, such as full name, Social Security number, address, and date of birth, are just required to open an account.

- Higher APYs. Apart from easy account opening, digital banks can boast higher annual percentage yields than traditional banks. Your deposit account may bring you more profit if you open it online. The regular bank will offer you an average of 0.01% APY, while some online bank platforms offer 0.50%. What does it mean? You may get around $50 annually on your $10,000 deposit compared to the $1 you will be given at a local bank.

- Fewer Fees. Large networks maintained by conventional banks usually are pretty expensive. Clients must deal with maintenance fees, while online banking is much more affordable. Several banks charge overdraft fees or a percentage of cash you withdraw at the ATM. There are lower, and no maintenance fees for your checking accounts or savings accounts opened online.

- Security. The Federal Deposit Insurance Corporation (FDIC) backs digital banks and traditional banking branches. The funds of up to $250,000 per bank account are protected against bank failure. This is excellent protection, while digital banking systems also have strong encryption to secure the client’s sensitive data.

- Additional tools. Apart from higher APYs and security, digital banks offer extra tools such as budgeting apps, automated savings options, and the ability to deposit checks remotely, transfer money between your accounts, and pay bills on the web.

According to the CFPB it’s easy to start online banking provided you have a smartphone or a computer with Internet access and a bank account eligible for Internet banking.

A few steps divide you from enjoying the benefits of mobile banking. You should collect your account numbers to have them on your paper statement.

Find the website of your credit union or bank in which you have an active checking account and register for access to its web banking platform.

Strong passwords are needed to protect your identity and sensitive data. After that, you can log in and use the services online.

Drawbacks of Online Banks

Source: unsplash.com

Digital banks offer many valuable features, but there are still some downsides you should consider before you decide to open a checking or savings account with one of the online banks.

- Limited Withdrawal and Deposit Options. Cash access is one of the significant issues with digital banking. You may quickly transfer the money between your accounts or write online checks, but depositing cash can be difficult. If you have one of the deposit-taking ATMs offered by your digital bank, you are lucky. Hence, this is the main reason many clients still have a checking account at a conventional bank so they can transfer their money to it. You may also face out-of-network charges if there isn’t an ATM close to where you live.

- Absence of Branches. You may be happy to have an opportunity to have digital banking on the go and the ability to avoid queues. However, sometimes it makes sense to visit the physical branch and have a personal conversation with the specialist. The elderly and people who aren’t good enough at computing or smartphone options may still need to go to a traditional bank to manage their finances.

- Fewer Account Options. Conventional banks offer a wide range of savings and checking accounts. Besides, you may find plenty of additional services such as investment options, lending tools, money market accounts, and CDs. All your funds can be easily managed in one place. Online banks have fewer account options and can’t compete with ordinary banks. If you want various services, you should find a bank that will provide them in one place.

The Bottom Line

Should you stick to the traditional banking system? Is it reasonable to have all your accounts in a digital bank? Each option has advantages are drawbacks. You should decide which way is more comfortable for you and your finances.

You may switch to digital banking but have a checking account opened in a traditional bank to access cash when you need it.

You might stay at the conventional bank but open a savings account in a digital bank to maximize the APY and enjoy higher savings.