Budgeting is a base that should be mastered by those who strive for financial awareness and independence. Without it, it’s difficult to form long-term goals (for example, to save for a car, an apartment, or equipment), and there is a risk of not being prepared for excesses (getting fired, extra spending at a casino online real money, or becoming seriously ill). Finally, it’s cost accounting that helps you understand which categories of goods eat up an exorbitant portion of your paycheck. Knowing about them, you can optimize spending and give up some of your bad habits. This is where apps can help.

Why Use Such Apps

Keeping track of your personal finances will help you save money on spontaneous purchases and channel them toward goals that are important and valuable to you. Furthermore, daily accounting will teach you how to keep your finances under control and form the habit of saving money.

So it’s time to find out what mobile services can help you keep track of your income and expenses.

A budgeting app can help you see how much money you make and where you spend it. You can track your income structure over several months and identify the predominant income (salary, income from business, hobbies, parents gave). You will also be able to track your expenses. You will get a clear picture of your cash flow. Such analysis will help you find ways to reduce expenses and start saving.

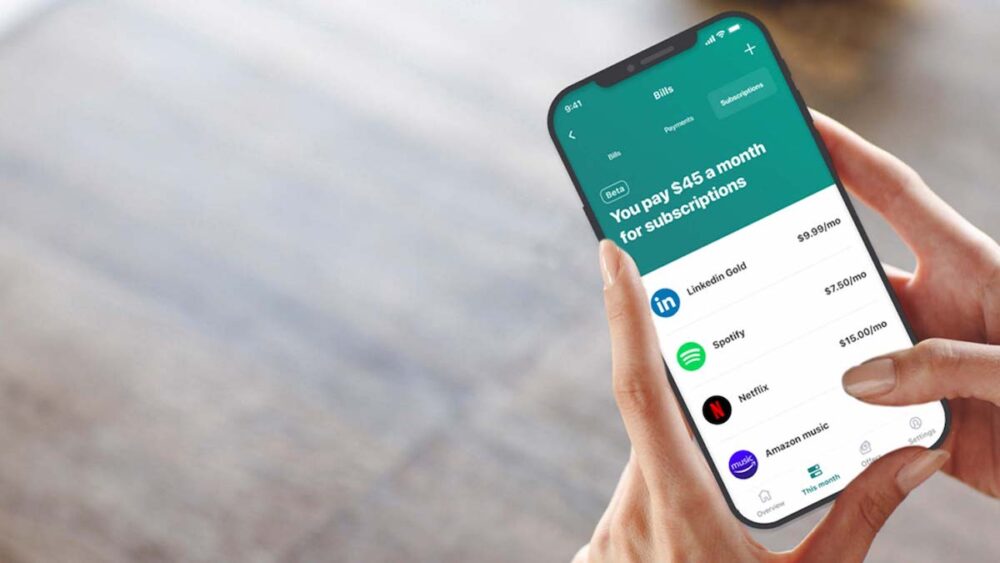

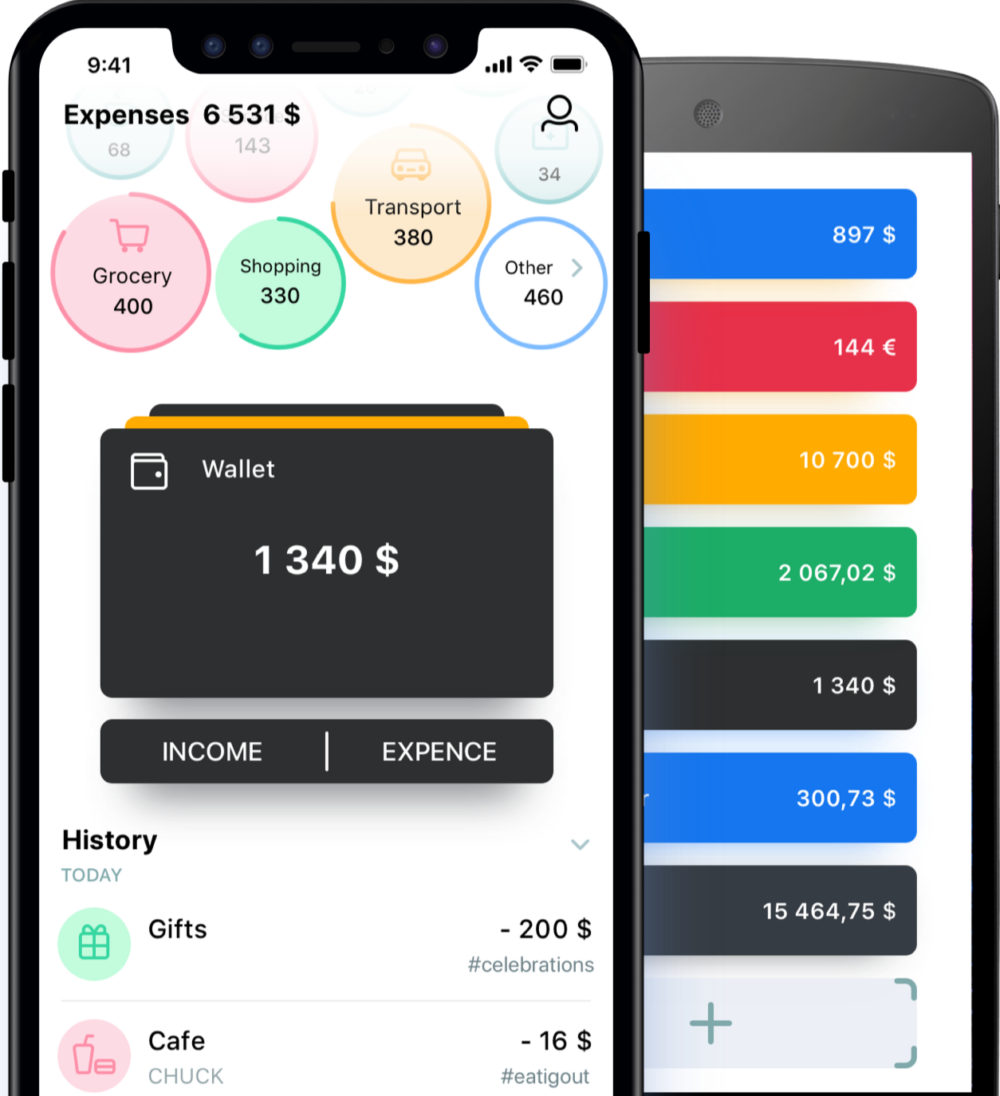

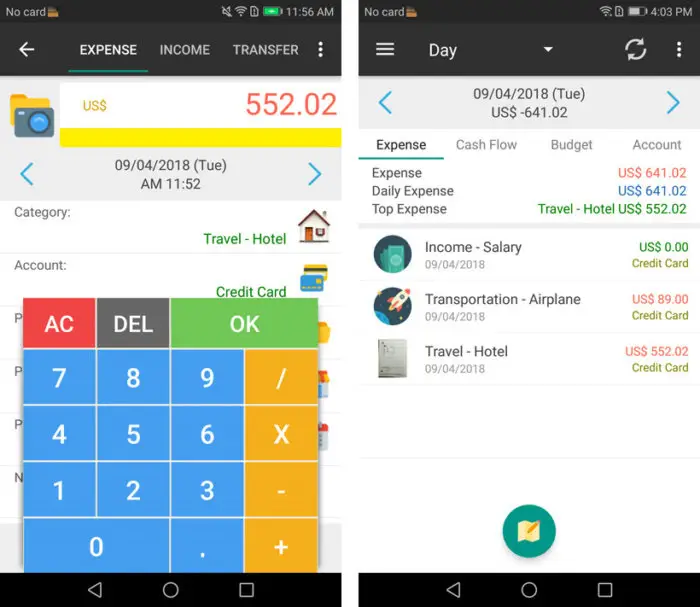

1. 1Money

Source: saashub.com

This is a relatively simple application that is pretty good at visualizing your spending. You can add several accounts (e.g. bank card, cash) and account for expenses both all at once and by individual accounts. In addition to the basic expense categories – “Cafe”, “Groceries”, “Transport”, “Health” and “Gifts” – there are many icons for subcategories, you can write their names yourself (for example, add “Gambling”).

The initial functionality is free, but it still may not be enough. Firstly, without a subscription you can add only two simple accounts, but the debt and savings (for example, to account for mortgages) cannot be used normally. Secondly, the free version does not synchronize with banks.

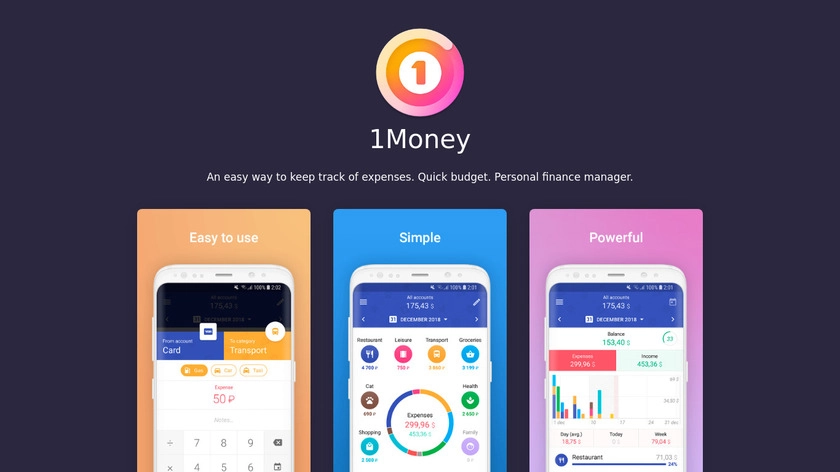

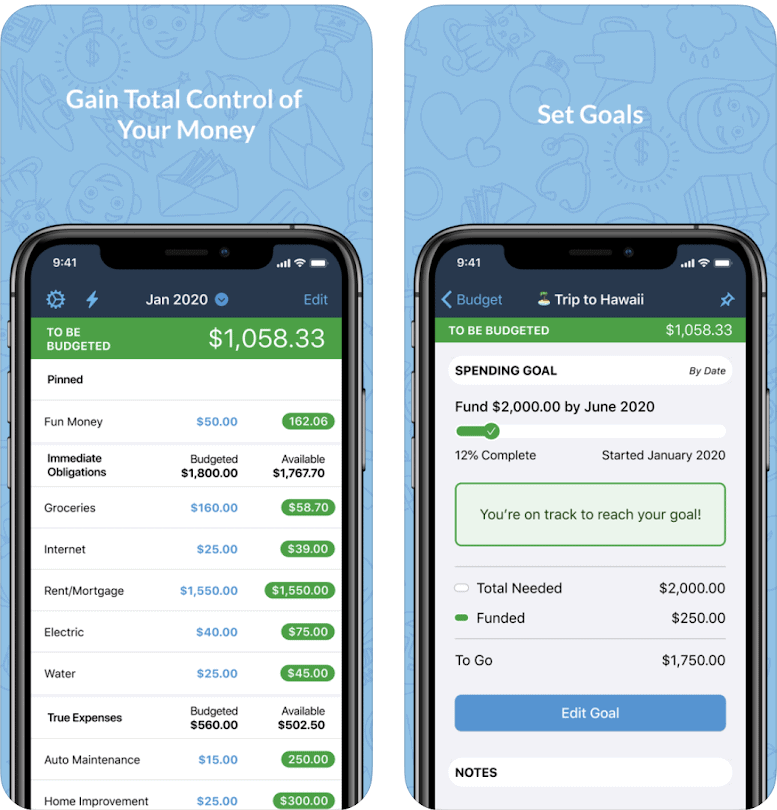

2. Money Manager Expense & Budget

Source: realbyteapps.com

If you prefer not icons, but data in a table form, then the Android version of Money Manager (iOS analogue of Money Flow). The app makes it easy to add income and expenses: with each transaction, the program finds out step by step which category they belong to. There are advanced settings with the ability to add groups of assets: deposits, investments, credit lines, and so on. You can leave notes and attach files. There is a calendar and graphs.

3. Cash Organizer

Source: softonic.com

The main feature of the app is synchronization with the bank. This eliminates the need to enter payments manually. Of course, the app has protection, which won’t let even the developers access the data. The interface of Cash Organizer isn’t so simple, but the problem is solved by instructions which clearly explain the algorithm of usage.

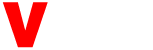

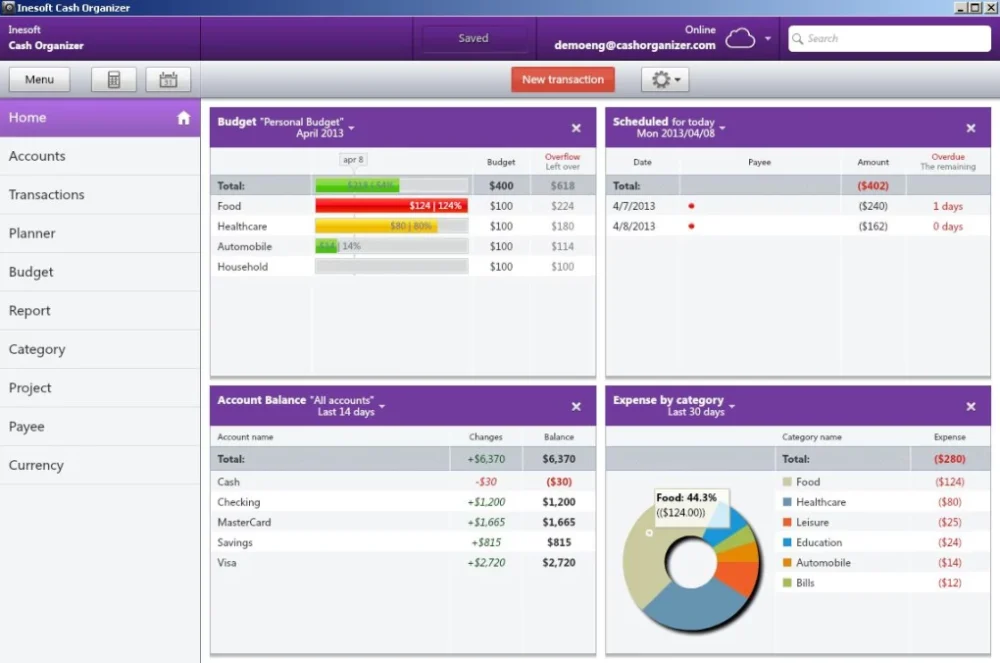

4. Wallet

Source: wired.com

In terms of design, it looks like the personal cabinet of the bank. Before using it, you need to register, choose the base currency and specify the current balance. The latter can be done manually or through the import of bank statements on the site. The free version of Wallet has up to three accounts, including accounts with different currencies.

5. CoinKeeper

One of the most popular apps, which is written about in every other selection. But apparently there are two versions of it – from the same developers, Disrapp LLC.

The trick of the old one is the special mechanics of accounting for expenses. You just have to drag and drop a dime from a particular account into the right category: from your wallet to the grocery section, for example.

The new version of CoinKeeper with the number “3” in the title is updated regularly, but its interface is radically different and resembles a full banking service with lots of settings and sections.

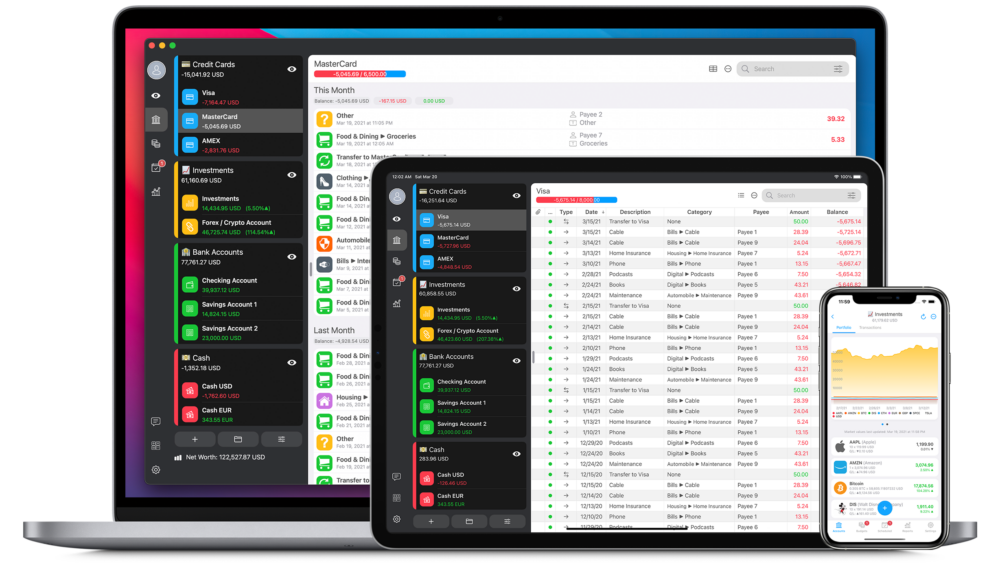

7. MoneyWiz

Besides the app itself, there is a desktop version available for Windows and Mac. Includes about 600 functions, but only if you upgrade to the paid version. It supports online banking, synchronizes trades, takes into account investments in securities, cryptocurrency. There is an option to create reports and financial forecasts. The number of functions in the free version is many times less.

8. Toshl

This app is fantastic for convenient management of 200 types of currencies and cryptocurrencies. Generation of reports for the selected period, the data can be transformed into charts. Personal cabinet allows you to enter all your bank accounts, a total of up to 14 thousand. There is a significant disadvantage: two budgets and two accounts are available for free, other functions of the application are available only by subscription.

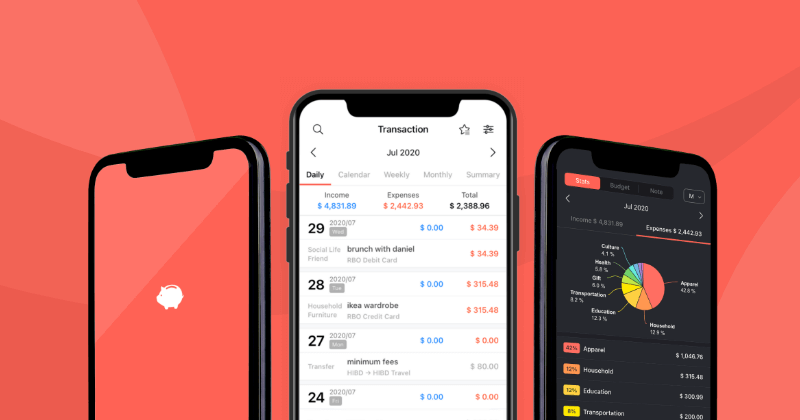

9. Money+

Probably the nicest financial app that will appeal to those who like illustrated design. But you will have to make certain sacrifices for its sake – to put up with clumsy Russian localization. The app is available on Android and iOS.

The free version has all the functionality, including a calendar and the ability to add different currencies, accounts and cards. The downside is that expenses and income will add up.

10. AndroMoney

Source: computerworld.com

This planner has a simple and clear interface. It is convenient to analyze expenses and income by charts. You can log into the application by password to protect your information from unauthorized people.

11. Moneon

The free version of the app, besides the standard features, has voice-activated transaction entry. An app for Apple Watch is also available. You can create your own expense categories and subcategories.

The premium version has SMS recognition, but no automatic accounting in the app: you need to copy the text of the message, start Moneon, and there will be a transaction in the desired currency. It is possible to add photos to expense records and keep a budget for the whole family, but this requires premium accounts for each user.

Alternative: Excel Spreadsheets

Source: popsci.com

Using a budgeting app isn’t necessary – a simple spreadsheet in Excel can suffice. The ideal spreadsheet is one that you’ve made yourself for your own needs.

There is another way to control expenditures, which requires even less effort – the Six Envelopes Method. Its essence is that you distribute your salary in envelopes in the following proportion: 55% for the essentials (rent, food, etc.), 10% for self-care (holidays), education, airbag and savings, another 5% – for gifts or charity. If you run out of money in any envelope, it isn’t advisable to take money from others.

Whether you use mobile apps, spreadsheets, or the envelope method, over time you’ll learn to avoid spontaneous spending.