Are you looking for security and stability in the present-day world? If we are talking about the financial sphere, you can reserve a safe airfield by having at least two accounts in different countries. We usually advise our clients to have an offshore account as major political upheavals may affect the business on the mainland but leave the islands intact. They are natural hiding places where you will always find the sun and the ocean, no matter when you decide to come.

Offshores have their hurricanes, of course, but these are mainly related to storms in the regulatory area: official organizations try to crack down on offshore areas from time to time, imposing more and more strict requirements. There are banks and jurisdictions that manage to keep the pressure and adapt, while others fail. And this is the reason why we keep a shortlist of currently recommendable banks and jurisdictions that our experts constantly update. We will share some information with you, and you can read more on the best countries for offshore bank accounts on our portal or order a free consultation to select the bank that suits your needs.

Why cannot we give a one-size-fits-all solution?

- First of all, there are your personal needs – or the needs of your business. Some clients need a focus on privacy, while others may need a crypto-friendly bank or high-speed wire transfers. Plus, there are counterparties based in particular countries, and some banks may be better suited for payments to them. We take into account the legal and banking regulations in the jurisdiction, as well as local practices.

- Second, when you have made a shortlist of suitable jurisdictions out of 60 offers available, you focus on the comparison. Costs of opening an account, fees to be charged to keep the account operational, application processing time, limitations set by the bank – all these factors exist, but not all of them may be important for you. And this is where priorities matter because it is impossible to find one perfect bank that meets whatever expectations you may have.

At this stage, most clients decide to save their time and hire a consultant, and this is a great decision. Still, we do offer a list of jurisdictions compiled by our experts that is based on a particular priority, and you can safely use that to get an idea and come to the meeting with an expert more or less prepared. We have made it taking into account the feedback of our customers and the current situation in each jurisdiction.

1. Suppose you come to us and say: I need an account in the best tax haven in the world

Source: theguardian.com

The first jurisdiction that we come up with is the Cayman Islands, with its high reputation in the global banking world and focus on low tax rates. Political and economic stability is a factor that contributes a lot to the safety of your assets. Stringent confidentiality requirements and the absence of currency controls are also among the merits of the country’s banking system. If you need to diversify your funds within the short term, the regulatory and legal system of the Cayman Islands will easily allow you to do that.

2. You may come to us with a request to offer the safest possible country to make a deposit.

And we would propose Germany without too much thinking. The advantages of the country’s banking system are as follows:

- Quite affordable fees

- Hassle-free account set-up procedure

- Financial stability

- Stringent security protocols

- State-of-the-industry banking technologies

Besides, an account can be opened online, which adds to the overall appeal of the German banking sector.

3. If you are an entrepreneur who wishes not only to open an offshore bank account in a suitable jurisdiction but also start a company there, we would recommend Nevis, of course.

Source: offshore-protection.com

Nevis is a good place to form a classical offshore company as it offers a low cost of registration, a pro-business financial system, and the strongest asset protection framework you may find. An account opened in Nevis will help you re-domicile your business to any country, expand it internationally, or merge it with other entities.

4. Do you need a country that offers excellent asset protection and truly second-to-none confidentiality? You will not find a better country than Switzerland.

Swiss banking is a globally recognized brand, and it is no wonder the banking sector has a special status in the country. Banking secrecy is held on a high level, and no party from the outside will get any information related to your banking, or the bank that disclosed it will be required to pay a heavy fine. Swiss banks are legally obliged to maintain the minimum amount of funds to guarantee reimbursement of clients’ losses if the bank goes bankrupt.

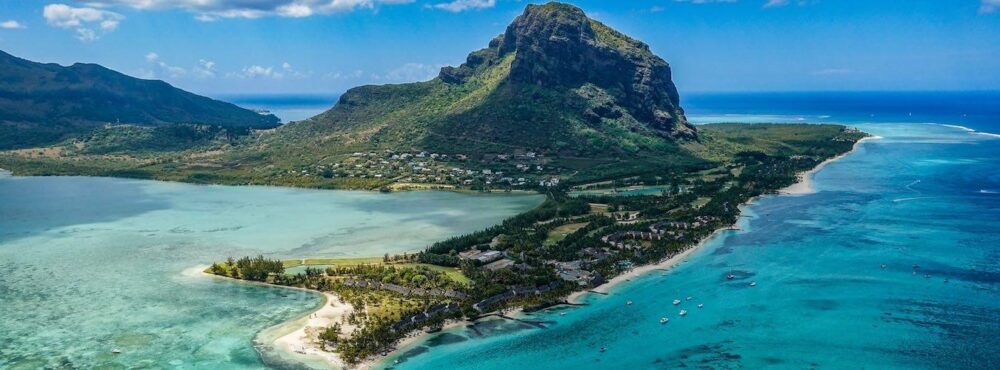

5. Looking for elite banking services? Try Mauritius.

Source: britannica.com

Mauritius banking enjoys a good reputation in the region, and you can take advantage of a wide range of services for individuals and legal entities. VIP clients that want to use the best services possible can obtain multi-currency elite bank cards, credit lines on favorable terms, wide geography of transactions, and diversified assets. Deposits are securely protected, and the country’s banking sector is really worth giving a try.

6. If you wanted us to recommend the most steady country to you, we would definitely choose Panama.

You will benefit from really stringent confidentiality rules set on a legal level and wide opportunities for asset diversification: invest in futures, bonds, stocks, or whatever you may choose. The country’s legal currencies are the Panamanian balboa and the US dollar, but non-residents can also open accounts in euros and pound sterling. The jurisdiction offers really good tax residency incentives.

These are the top 6 options that we wanted to introduce you to. Of course, there are many more jurisdictions that may suit you perfectly, and we know that. If you need a precise fit, please schedule a meeting with our expert as the degree of your asset protection, financial security, and many more things will depend on this decision. How much do you value these aspects of your life? And this is a good question to ponder…